OUR ULTIMATE GOAL IS TO DELIVER THE RIGHT INFORMATION, THE FIRST TIME. WHAT WE DELIVER ENABLES, SUPPORTS, AND GUIDES OUR CLIENTS IN MAKING SOUND, FACT-BASED BUSINESS DECISIONS.

The Research Investment (TRI) has been at the forefront of delivering comprehensive business research solutions. Our mission is clear: to provide precise, relevant information to guide your critical decisions effectively.

We don’t experiment on you.

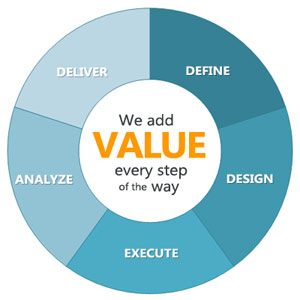

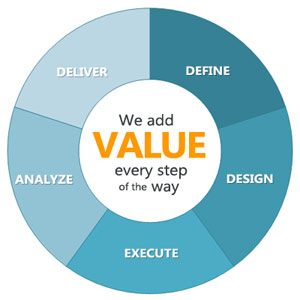

We understand what works and what doesn’t. Our seasoned professionals follow a meticulous research design process. Collaboratively, we define your project’s research objectives and ultimate business goals, ensuring an optimal research methodology while respecting your time and budget constraints. From execution to result delivery, we take care of every detail.

Law Firm Research and Paralegal Services

In the realm of law, we excel in unearthing critical, often elusive documentation that bolsters court cases. Our expertise extends to IP law practices, where we specialize in creative non-patent prior art research, uncovering obscure and retrospective documents crucial for legal success.

Additionally, we offer professional paralegal services, including supplemental support for your legal team, document preparation, business and employee/employer mediation, legal research, interviewing, fieldwork, and data collection. Each project is tailored to your specific needs.

Market and Industry Research and Analysis

Industry profiles, media scans clipping services or RSS feeds on industries or competitors, environmental scans; collecting, filtering, organizing, and presenting

data.

Marketing & Branding Research

Our customized research lights the path for marketing and branding strategies – for individual products & services, business divisions, and entire companies. At the core of every project are in-depth interviews of prospective customers. We explore their knowledge, perceptions, loyalties, biases, and buying practices. If the purpose is to craft a new package, a new message, or a new name, we learn what most attracts and engages different customer segments – and why.

Institutional and Government Specialized Research

Academic Institutions

Our research for colleges, universities, and secondary schools has ranged from surveying students, faculty, alumni, and parents to working hand-in-hand with administrators to develop new institutional branding and marketing plans.

Healthcare Institutions

Most of our work for healthcare institutions supports their external marketing efforts. For example, we recently completed an in-depth perception study for a major hospital based on interviewing hundreds of residents in surrounding communities. In addition to hospitals, we’ve worked for nursing homes, home health organizations, and assisted living retirement communities.

Nonprofit Institutions

We help nonprofits with both internal and external issues. On the internal side, we recently benchmarked the compensation packages of selected museum directors across the country. On the external side, we frequently assess awareness and perception among different stakeholder groups, as well as explore new ideas for growing visitors, memberships, and endowments.

Government Research

For decades, we have honed our expertise in government statistics to bolster quantitative market research efforts. Our ability to anticipate the data collected by government agencies, along with where to access it, is a substantial time-saving advantage.

Company Intelligence

Our expertise goes beyond competitors, extending to customers, suppliers, distributors, acquisition targets, and business partners. We uncover vital information about their operations, strengths, weaknesses, and future plans through interviews, meticulous research, and global databases.

Industry Specific Research

With over two decades of B2B research experience across numerous industries, including healthcare, biotechnology, polymers, automotive, and education, we offer an insider’s understanding of these sectors. We have a solid grasp of how these industries operate and excel in providing critical insights.

Our commitment to delivering precise, actionable information and our extensive experience set us apart. With The Research Investment (TRI), you gain a research partner dedicated to your success.

The Research Investment (TRI) has been at the forefront of delivering comprehensive business research solutions. Our mission is clear: to provide precise, relevant information to guide your critical decisions effectively.

The Research Investment (TRI) has been at the forefront of delivering comprehensive business research solutions. Our mission is clear: to provide precise, relevant information to guide your critical decisions effectively.